商用车

2022-07-22

电动卡车销量的激增将刺激零部件供应商收入的增长

Jamie Fox

Jamie拥有超过15年行业研究经验,研究范围涵盖了商用车及其动力总成零部件系统。他拥有物理学和天文学学士学位,以及纳米科学与技术硕士学位。Jamie目前在智利工作。

Electrified component shipments are driven by sales of battery electric vehicles (BEVs). From a BEV perspective, serious revenue growth will not begin until after 2022, but different segments of the market will grow at different rates. For example, buses in Western Europe will have very fast growth between 2022 & 2023, but much less growth at the end of the decade because the market will be saturated. Whereas vehicle types such as heavy-duty trucks will see most growth at the end of the decade. Understanding growth by vehicle sector is important for component vendors because some categories such as heavy-duty trucks have much higher component revenues per vehicle.

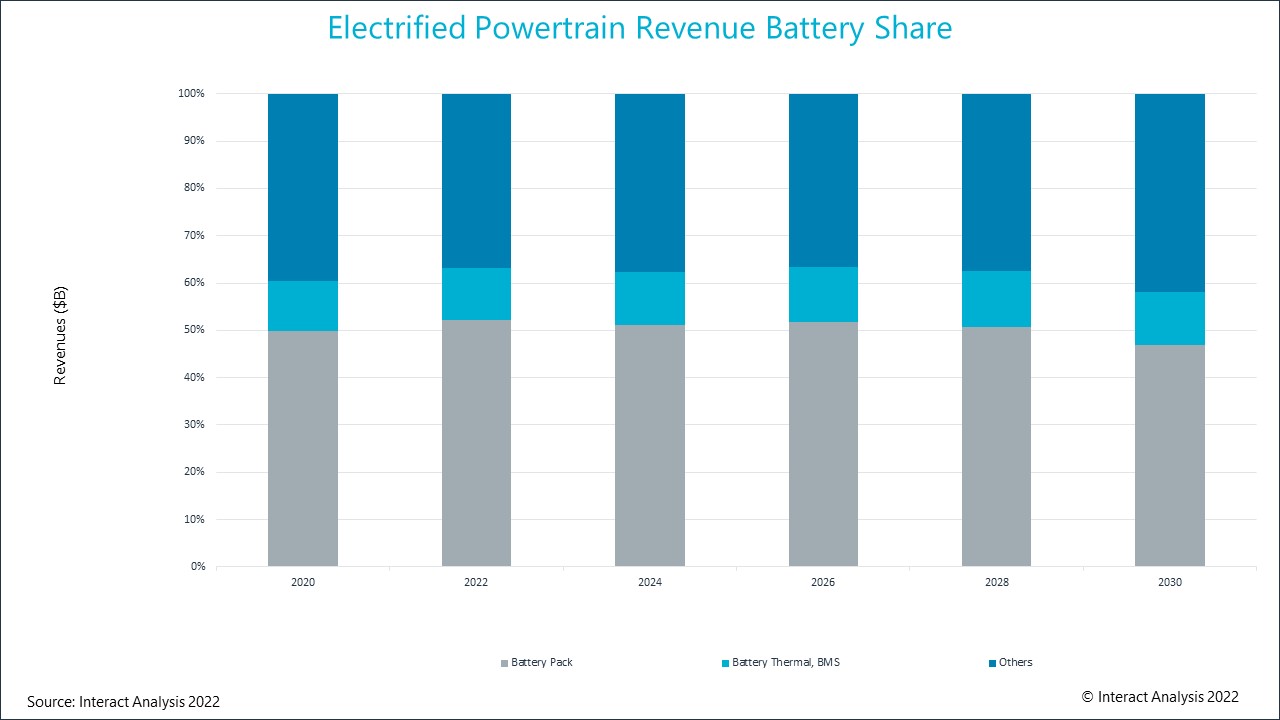

The battery pack dominates

Over 50% of powertrain component revenues currently come from the battery pack alone. Battery pack revenue growth is set to peak in 2026 before slowly decreasing in share as fuel cell technologies begin to gain more traction in the latter part of the decade. By 2025, the battery pack is set to bring in over $37bn in revenue versus only $1 billion for fuel cells & hydrogen tanks. Fuel cell componentry has a long way to go before it can come close to competing with battery electric because fuel cell systems are so expensive.

Revenues from the battery pack will peak in 2026 and begin to dip as other powertrain types (FCEV) gain traction.

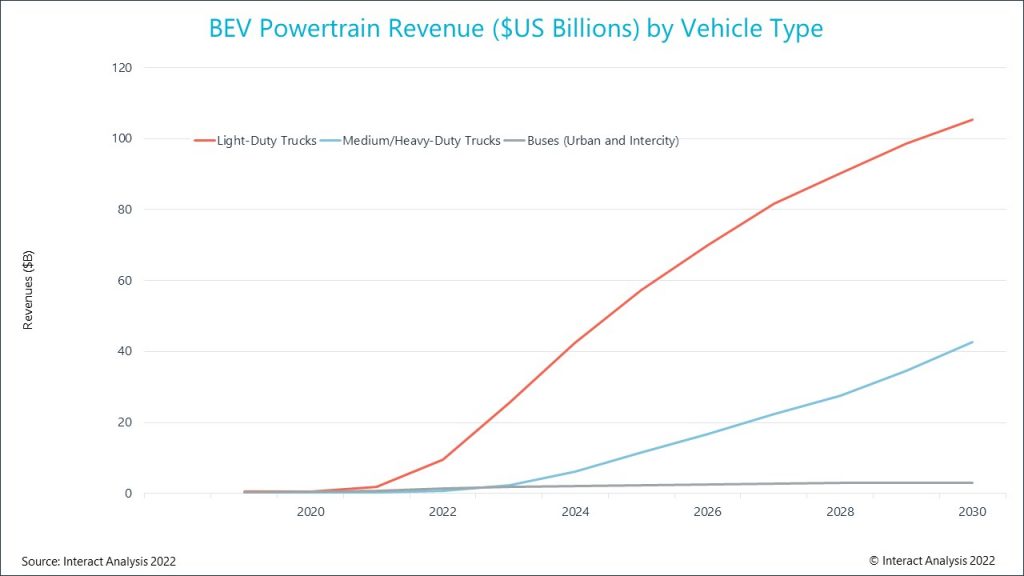

Light-duty trucks will lead the way

The majority of powertrain revenues between 2022 & 2027 will come from light duty vehicles due to the sheer level of demand for them. Ford and Tesla’s new pickup truck models will contribute significantly to this. Towards 2030, medium and heavy-duty trucks will begin to gain a larger market share of BEV powertrains. By 2030, light duty vehicle component revenues will rise to $106 billion compared to $66 billion for heavy duty trucks. In contrast, the market for electric buses is much smaller and therefore powertrain component revenues for buses will reach only $3.5 billion in 2030.

Light duty trucks will contribute significantly to BEV powertrain revenues.

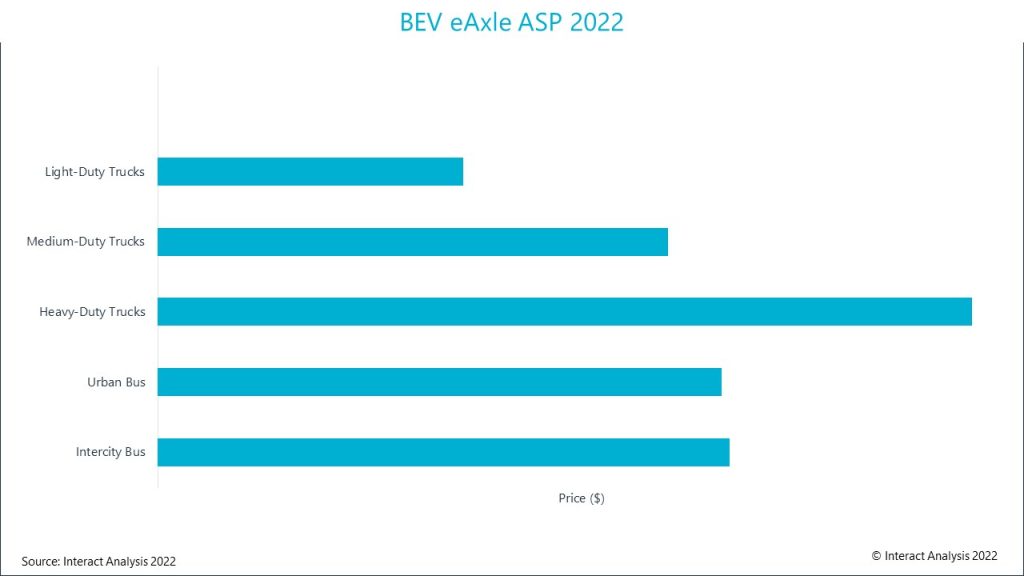

eAxles will become more competitive over time

Currently, it is more expensive to specify an eAxle than to have a discrete motor and transmission. Despite this, they offer OEMs many benefits, particularly saving space in the vehicle, as well as savings on housing/wiring costs. The space savings offered by eAxles potentially allow the eAxle to pay for itself because they deliver significant overall vehicle cost benefits. These cost benefits can be either adding value to the vehicle by giving it additional additional capacity, or cutting production costs by allowing an overall smaller vehicle with the same storage capacity. eAxle prices will also come down over time as the technology matures and up-front R&D costs decline. Our price forecasts have eAxle pricing in 2030 as being less than half that of 2021. Consequently, we can expect to see stronger uptake of eAxle componentry towards the end of the decade.

Average cost of an e-Axle for a BEV in 2021 was $5557 reducing to $3403 by 2030.

Average powertrain value is growing over time, but this is misleading

Between 2022 and 2030, the electrified truck and bus market is poised for significant growth. Component vendors should pay strong attention to powertrain value per vehicle as they decide which markets to tackle. Average powertrain value is about $30,000, but it can be as low as $2,000 for a mild hybrid light duty truck and as much as $100,000 for a battery electric truck (and even higher for a fuel cell truck). Larger and more powerful vehicles, as well as a move away from hybrids (the cheapest powertrain type) and toward batteries, will drive an increase in average overall powertrain price between 2020 and 2024. However, if we look at a given size of vehicle with a given power, average power train costs will decline from 2023 onwards due to improved production innovations and economies of scale.

For more information, contact principal analyst Jamie Fox, author of the report: Electrified truck and bus powertrain components (Americas & EMEA) jamie.fox@interactanalysis.com