商用车

2022-12-12

2030年亚太市场新能源商用车电驱动桥出货量有望超160万根

Shirly Zhu

Shirly一直专注于制造业领域的市场研究,行业涉猎广泛,涵盖新能源、化工、工业自动化、海事、汽车等行业的全球及本地化调研项目,积累超10年的一手及二手信息调研、数据及行业分析经验。

In order to deliver higher efficiency rates and drive down costs in the powertrain component market, companies are looking at integration. As the trend continues to grow, more solutions are coming onto the market, including eAxles and Multiple-in-One electronics.

eAxles offer an excellent opportunity for component integration, which comprise a single unit that includes a motor, a transmission, and sometimes other components located on or very near the axle. The type of eAxle varies for electric buses and trucks. Currently, two types of eAxles are commonly adopted in Asia Pacific, particularly in China. Inline/rigid eAxle (High integration of motors and drive axles) are applied to small-sized buses and light-duty trucks, while parallel/vertical eAxle (where drive motors are connected to the drive axle in parallel or at right angles) are best suited for medium and heavy-duty trucks.

They offer a broad range of advantages, including total space saving, weight reduction, elimination of components and improved drive efficiency. A number of leading axle and motor producers are developing such integration solutions in Asia Pacific, including Dana, Hande, and BYD. Market demand is increasing and will likely fuel market competition in the future.

Product table outlining features of inline and parallel eAxles.

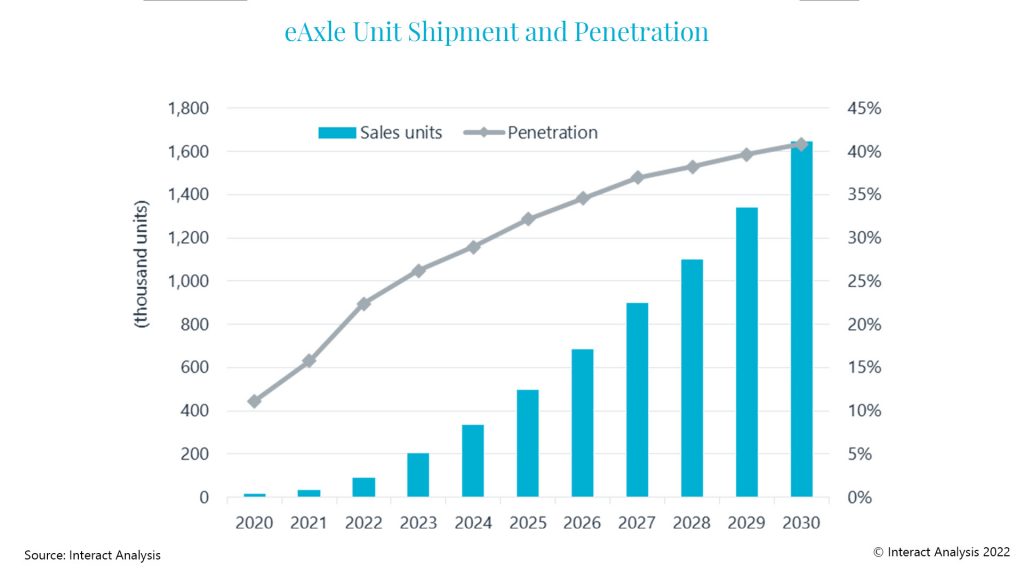

Overall, market penetration of eAxles remained limited in Asia Pacific in 2021, with sales largely concentrated in the light-duty vehicles sector. This is because eAxle pricing for light-duty vehicles is currently competitive when compared with traditional motor architecture, but pricing for heavy-duty vehicles is estimated to be 30-40% higher, meaning there is a high-cost tradeoff for high efficiency. In addition, concern over the difficulties of maintenance and the necessity of space saving for battery installation (particularly for heavy-duty trucks) also influence decision making by OEMs deciding whether to adopt eAxle solutions. With increasing penetration rates, particularly in light-duty vehicles, the average market price for eAxles in APAC is projected to fall dramatically to around $1,200 per unit by 2030. eAxle shipments are expected to increase by 54% annually to over 1.6 million units in 2030. As a result, penetration in trucks and buses could reach 41%, up from 16% in 2021.

eAxle sale units set to soar out to 2030.

Another form of integration and one that is most commonly used in electric buses and trucks, is Multiple-in-One electronics. This technology incorporates a combination of the motor inverter, DCDC converter, onboard charger (OBC) and high-voltage power distribution unit (PDU). Reducing the number of components in electric vehicles improves efficiency rates and the reliability of the system. Other benefits of this form of integration also include greater flexibility when it comes to packaging, as well as saving space and costs. The cell-to-pack and cell-to-chassis technology integrates battery cells directly into a pack without requiring modules, improving the volumetric energy density of the battery mold and system.

The trend towards eAxles is growing and it is likely to accelerate towards the end of the decade. This solution offers many attractive benefits, such as space and cost savings, and improved efficiency. Increasing demand is likely to lead to greater competition within the market over the coming years, with new vendors and products entering the space.

For more information on the electrified truck and bus powertrain market, contact Shirly Zhu, Principal Analyst.