机器人 & 仓储自动化

2023-10-11

整体下滑的仓储自动化行业中,三个细分领域表现出增长势头

Rueben Scriven

Rueben是全球仓储自动化行业中领先的研究分析师之一,经常在全球重要的行业活动上发表演讲,主持过多个行业研讨会。

The global warehouse automation market has witnessed a contraction, with orders expected to remain sluggish into 2024. However, certain sub-segments of the market are seeing significant growth and offer new opportunities in turbulent times.

During the pandemic, we saw record levels of warehouse automation investments, driven by higher e-commerce sales and a boom in speculative warehouse construction. However, fast forward to today and the warehouse automation market is struggling with declining order intake and prolonged sales cycles, which led to a contraction in 2022 and another declining year in 2023. Given the inflationary environment and the resulting high interest rates (which aren’t due to come down any time soon), we expect a relatively sluggish 2024 with limited order intake growth.

In light of a troubling macro-economic environment, it’s more important than ever to find market segments that are poised for growth. Indeed, within the wider declining market, there are particular sub-segments experiencing phenomenal growth. We’ve spent the last eight months surveying and interviewing automation vendors and end-customers to identify and quantify these outliers. The report, publishing later this month, will be critical for those looking to navigate today’s turbulent market conditions.

This insight will explore three growth markets that are bucking the wider trend and expected to experience significant growth over the coming years. We’ve chosen these growth segments at random from a much wider selection that will be included in the full report.

US Manufacturing

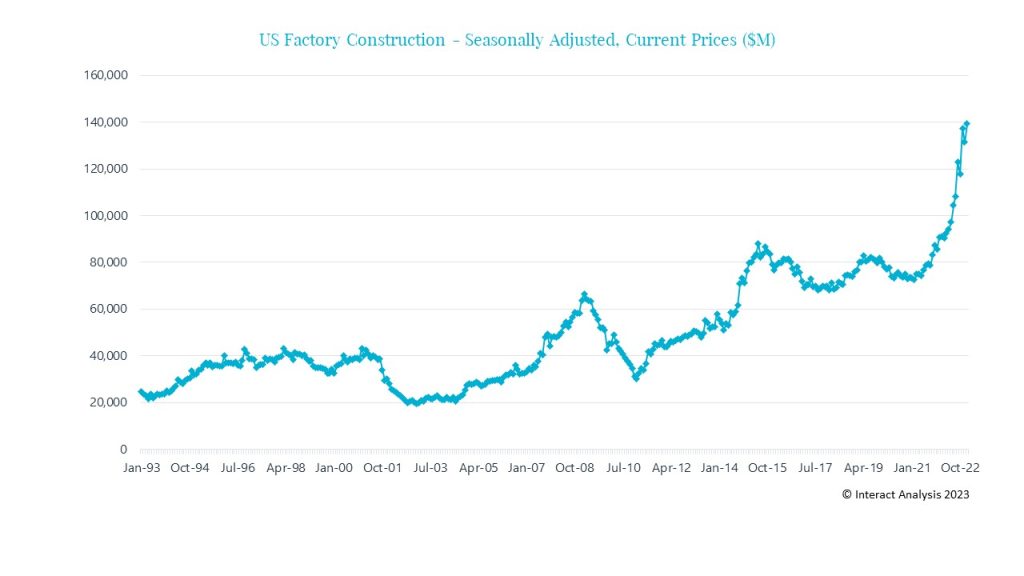

Given the supply chain disruptions caused by COVID-19, several large international companies are in the process of near-shoring and re-shoring their production. The data below shows the amount spent on factory construction in the US, which clearly demonstrates a huge increase in investment in US production capacity. Our initial hypothesis, formed back in 2020, was that this near-shoring would result in higher levels of investments in warehouse automation from manufacturers. In 2022, our assumption was validated as we saw nearly all companies reporting significantly higher revenues generated from the durable manufacturing vertical in the US. We saw a similar trend in Europe but to a lesser extent than the US.

Despite wider economic malaise, investment in US production capacity has risen sharply

In addition to the near-shoring trends, the US also announced its Inflation Reduction Act, leading to a large increase in EV production in the US. Factories building electric vehicles or related products, such as batteries, tend to be highly automated and often have associated automated logistics systems. Indeed, many of the automation vendors we spoke to as part of our research indicated that they’re receiving a lot more demand from EV manufacturers.

Pet Care

During the pandemic, the number of furry friends went through the roof. In the UK alone, the share of households owning pets went up from 40% in 2019, to 59% in 2021, and to 62% in 2022. The more pets there are, the more pet care products are required. For example, Chewy, a US-based pet care e-commerce company, has opened a large number of automated facilities in recent years and says that it will continue to do so. Pan Pacific Pets will be using Attabotic’s storage system, while Pet Supplies Plus invested $53 million in a new distribution center in 2022. Although the pet shop boom isn’t expected to last in the long term, it appears likely to outperform the wider market in the short term.

Healthcare

In recent years, the US has introduced a new set of regulations encompassed by the Drug Supply Chain Security Act, which requires manufacturers and distributors to electronically trace drugs all the way from manufacturing to consumption. All trading partners have until November 2023 to incorporate the requisite serial numbers into their processes. While most wholesalers and distributors have invested in the technologies required to comply with the new regulations, our research indicates several companies haven’t invested enough to bring their systems up to speed and will be throwing labor at the problem initially.

In fact, pharmaceutical distributors are calling for the FDA to extend the introduction of the DSCSA by two years, claiming that “industry still does not have the necessary tracing systems in place to comply with the law”.

As part of our research, we’ve spoken to a large number of stakeholders in the drug wholesale and distribution sector, and it’s clear there’s going to be a lot of investment in automation in the coming years as distributors and wholesalers look to become compliant.

Final Thoughts

Given the troubling macro-economic environment, it’s more important than ever to identify growth prospects. According to an article ‘How to Use Market Research during a Recession’, published in the Harvard Business Review, it’s critical to use ‘trusted partners’ when conducting market research.

The Warehouse Automation – 2023 report, publishing later this month, will discuss in detail all of the growth segments in the warehouse automation market, providing vendors with a tool to identify opportunities and navigate the current turbulent industry conditions.

With offices in the UK, the US and Asia, Interact Analysis provides off-the-shelf and custom international market research that is rooted in deep expert analysis of three key industries (robotics & warehouse automation, commercial vehicles, and industrial automation). Our information is high quality, reliable and considered, providing the crucial insights needed to respond to changing industry trends and win.

To learn more about our research and predictions for the warehouse automation market, get in touch with Rueben Scriven directly: Rueben.Scriven@interactanalysis.com