商用车 工业自动化

2022-07-28

机电制动器是否会挤占线性油压马达的市场空间?

Brianna Jackson

Brianna拥有生物学和化学学科背景,她对可持续发展和医疗技术有着浓厚的兴趣,为IA团队在这些领域的专业知识增添了更深层次的洞察和见解。

As vehicle electrification continues to gain traction in the off-highway vehicle market, mobile hydraulic components and architectures will have to change to support electrified powertrains. One of the most obvious changes facing the mobile hydraulics market is the threat of total replacement in favor of electromechanical solutions. Fortunately for hydraulic suppliers, traditional hydraulics offer unmatched power density.

However, there are applications with low power demands and flexible duty cycles which could foster this kind of hydraulic substitution. In the most recent edition of our mobile hydraulics report, our data suggests that hydraulic cylinders may be replaced by electromechanical actuators within vehicles in the material handling sector more quickly than previously thought.

High Growth and High Substitution in the Material Handling Sector

For select applications the power density and cost obstacles for replacing hydraulic cylinders with electromechanical actuators are already relatively easy to overcome. This is particularly true for material handling vehicles such as forklifts, aerial work platforms, and telehandlers. Within the material handling sector, the advantage of replacing hydraulics is multi-fold: improving vehicle efficiency, preventing fluid leaks, and noise reduction. For example, JLG’s Davinci AE1932 electric scissor lift features zero hydraulics, instead opting for electromechanical linear actuators in place of hydraulic cylinders.

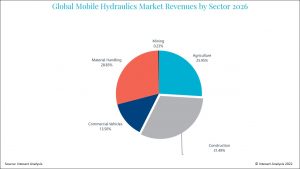

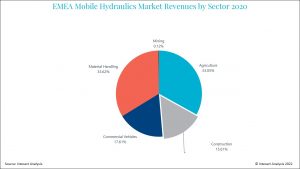

Despite electromechanical actuators being highly suitable for applications within the material handling sector, hydraulic sales to the sector are still rapidly growing. Sales of hydraulics within the material handling sector are projected to overtake agriculture by 2026. As a result, the material handling sector will become the second largest sector in the mobile hydraulics market. Much of this can be attributed to the rapid growth which is forecasted for forklift sales within warehousing applications over the next several years.

Global-mobile-hydraulics-revenue-by-sector-2026

Global-mobile-hydraulics-market-revenues-by-sector-2020

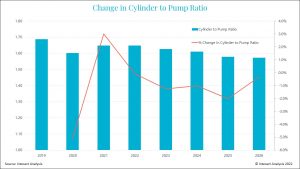

The question then becomes to what extent will electromechanical actuators penetrate the market and replace traditional hydraulic cylinders. In our research, we quantified the rate of total hydraulic replacement of cylinders through an analysis using a ratio of cylinders per pump in the market. To explain in greater detail, we estimated that for the entire market the number of cylinders per pump sold was 1.68 in 2019. However, we expect that ratio to decline to 1.57 by 2026. This represents an overall decline of -6.4% over the forecast period.

For the material handling sector, this decline in the number of cylinders per pump is even steeper at -8.8% over the forecast period. This would imply a greater rate of replacement in favor of electromechanical actuators within the material handling sector. This analysis should be taken with a pinch of salt as changes to the number of pumps will also impact the ratio. We do believe however, is that it’s directionally insightful and the results mirror what we heard during interviews with hydraulics suppliers and OEMs.

change-in-cylinder-to-pumo-ratios

Which Vendors are Riding the Trend?

Vehicle OEMs are risk averse in changing the systems which have already been proven for their vehicles, hence, change in vehicle architecture happens slowly. However, OEM sentiment may be warming to altering vehicle hydraulic architectures as the rate of electrification picks up. Many market leaders in the global mobile hydraulics market do not offer hydraulic cylinders. Resultingly, the hydraulic cylinder market is significantly more fragmented. This leaves a wide-open field for both hydraulic vendors as well as motion control product vendors to fill this space. So far, most of the electromechanical actuators that would be suitable for mobile applications are offered by vendors such as Thompson and Ewellix, two vendors that are steeped in the motion control market. There are also smaller startups entering this market such as Sweden-based Cascade Drives whose technology is already being utilized in forklifts. This is clear evidence that vehicle electrification will offer opportunities for the motion control vendors that were previously reserved for hydraulics suppliers.

In anticipation of this trend, many mobile hydraulics vendors are expanding their technological expertise by acquiring and partnering with electromechanical actuator manufacturers. For example, Danfoss has recently announced a partnership with RISETM Robotics with the goal of producing an electromechanical actuator that can match traditional hydraulic cylinders in terms of power. The partnership is intriguing from a strategic viewpoint because Danfoss isn’t a player in the traditional cylinder market. This move could indicate a shift in priorities from just optimizing individual components to providing whole system solutions that can maximize efficiency. Other top vendors such as Bosch Rexroth and Parker Hannifin feature electromechanical actuators in their industrial portfolios which they could feasibly expand to mobile machinery.

While hydraulic cylinders are unmatched in terms of power density and are unlikely to be displaced in most applications in the near-term, they could be replaced by electromechanical actuators in applications that have lower power-density requirements. The material handling sector is more poised to adapt the technology due to benefits such as noise reduction, leak prevention, and enhanced control.

Final Thoughts

As electrification in off-highway continues to develop, mobile hydraulic vendors will need to be continuously monitoring these sorts of trends. Status-quo bias can be prevalent in mature markets, and it will be important for mobile hydraulic suppliers to recognize that some level of substitution is likely to occur. While this substitution will represent lost business for some, it represents an opportunity for forward-thinking suppliers, and we expect many to jump on the trend.

To learn more about the move to electromechanical actuators, get in touch with Brianna today: Brianna.Jackson@InteractAnalysis.com