工业自动化

2022-01-31

欧洲能源危机会如何向电机价格传导压力

Blake Griffin

Blake是自动化系统、工业数字化和非道路移动机械电动化方面的专家。自2017年加入 Interact Analysis 以来,他撰写了有关低压交流电机驱动器、预测性维护和移动液压市场的深入报告。

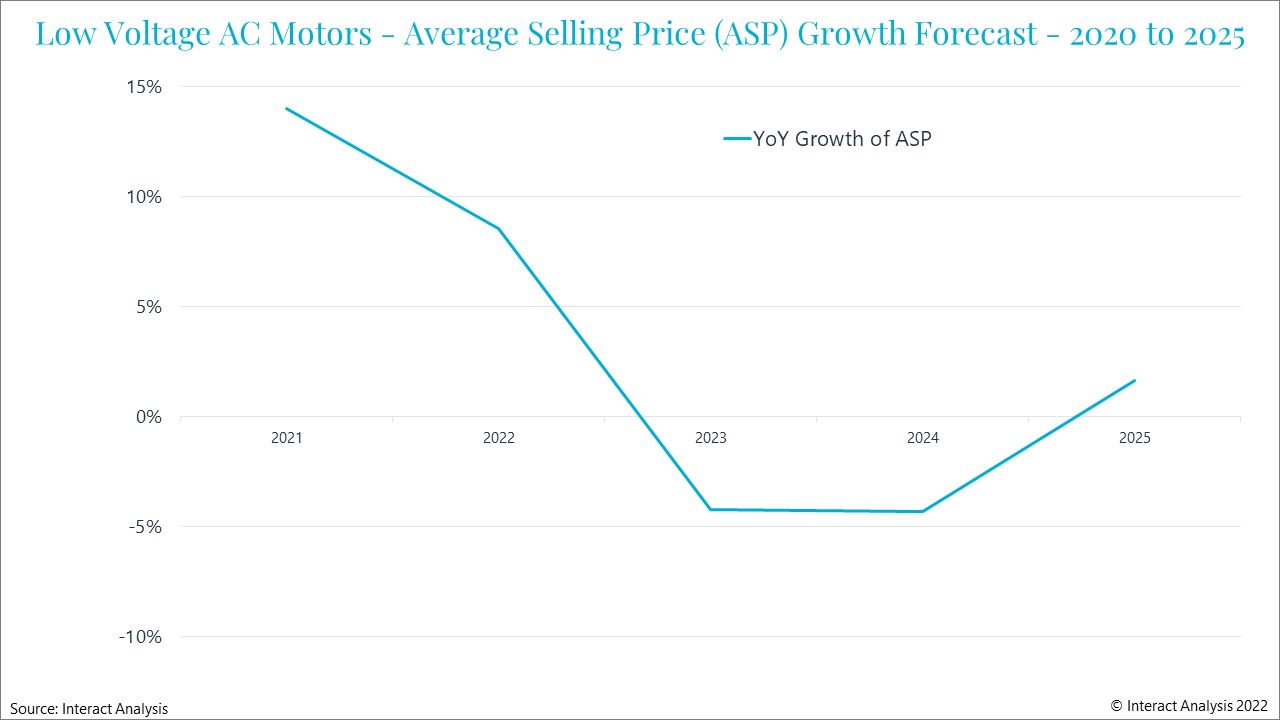

2021 saw a massive increase in revenues for low voltage AC motor vendors. The main reason: increased prices. In 2021 the average global sale price of low voltage AC motors was up 14% compared with 2020 pricing levels. While the Americas and European regions saw the largest price increases, Asia Pacific (APAC), generally a region more resistant to price hikes, still saw an increased average sale price of 5.3% in 2021.

With the topic of inflation consuming global headlines, a price increase was expected in the motor market in 2021. However, the levels of price increase seen in the AC motor market during 2021 far exceed the increases we’ve seen in many other markets we cover. For example, variable frequency drive prices increased on average by less than 5% globally. So what is it about the low voltage motor market that has warranted such a drastic increase in price?

The short answer to the question is that raw material prices are up. The pricing of motors is closely tied to the cost of the raw materials, namely, copper, aluminum, and magnetic steel. Each of these raw materials experienced dramatically increased pricing over the course of 2021. So perhaps the more important question to be asking is “why have raw materials increased so dramatically, and in which direction are they trending?”

Entering 2022, the global economy is still riddled with supply chain issues resulting from reduced supply capacity in early 2020 followed by a strong resurgence of demand. A highly publicized global shortage of available shipping containers continues to delay shipments of goods all while demand continues to remain strong. This has resulted in shortages across the supply chain in nearly every industry, resulting in higher prices. This is certainly a contributing factor to increased raw material prices and an entire insight could be dedicated to this complex issue. However, we’d like to focus on a different topic which is equally impacting the pricing of raw materials: energy prices.

How Do Energy Prices Impact Motor Pricing?

The macroeconomy is an incredibly complex web of intertwining supply chains, each having ripple effects on the other. A perfect example of this complex web is the relationship between energy and motor prices. When we refer to energy prices, we are referring to the price of the commodity which is being converted to energy. For the purposes of this insight, we are mainly referring to the price of liquified natural gas (LNG), oil, and coal. Prices of each of these commodities were on the rise amidst production challenges and a sharp uptick in demand for goods. This imbalance in demand and supply has resulted in shortages of these key resources which is reflected in the higher price.

Rising energy prices are forcing substitution for more alternate sources of energy, namely coal.

A shortage of available LNG in early 2021 led to heavy substitution for coal globally. This in turn constrained the supply of coal. This was a particularly large problem for China who is the world’s largest consumer of coal globally. As we have mentioned in a separate insight, this is one of the reasons China is currently enduring an energy crisis in parts of the country. China is the world’s largest coal producer by a hefty margin. However, the Chinese government is actively taking steps to reduce its dependence on coal as part of an effort to reduce carbon emissions. This policy, important as it is, came shortly before this shortage came to fruition. Resultingly, China was forced to take drastic energy conserving actions to protect its own supply including the limiting of production from its energy intensive industries.

Steel is among the most important raw materials in the production of low voltage AC motors. Steel production also happens to be one of the most energy intensive processes in industry. China, who is the world largest steel producer, was forced to limit its production of steel in order to satisfy its own demand for energy. In addition to limiting production, China also announced a rise in export tariffs on 23 steel products in mid 2021. All of this is in effort to conserve energy and curb emissions.

The effects of this were felt by steel consumers immediately. In late July of 2021, steel prices soared and motor vendors were forced to raise prices. Since this time, steel prices have come down in part due to the lifting of Trump-era tariffs on imported steel to the US. Despite this price reprieve, steel remains at elevated levels when compared to 2020.

Europe’s Winter Could Once Again Cause a Supply Shock

The International Energy Agency wrote in October of 2021 that energy market dynamics largely depended on whether or not Europe has a colder than average winter. Their argument, which we agree with, is that the low levels of liquified natural gas reserves in Europe (15% below historic average going into winter) will force the region to import the resource at higher levels.

There is a fear that an increased level of imported LNG to Europe could constrain global supply and once again lead to heavier coal substitution. If this occurs, China’s already challenged supply will face even greater demand. This could result in the region once again taking action to protect its supply by putting production caps on steel and other raw material producers, leading prices to rise once again.

As we enter February, the most intense portions of winter are still ahead. If the winter is particularly bad, expect rising steel prices once again and a potential for an additional rise in motor pricing. We forecast an increase in the average selling price of motors of 8.5% globally in 2022. This 8.5% increase is partially made up by increases in late 2021 which have rolled into 2022. However, we also have taken into account expected elevated steel prices.

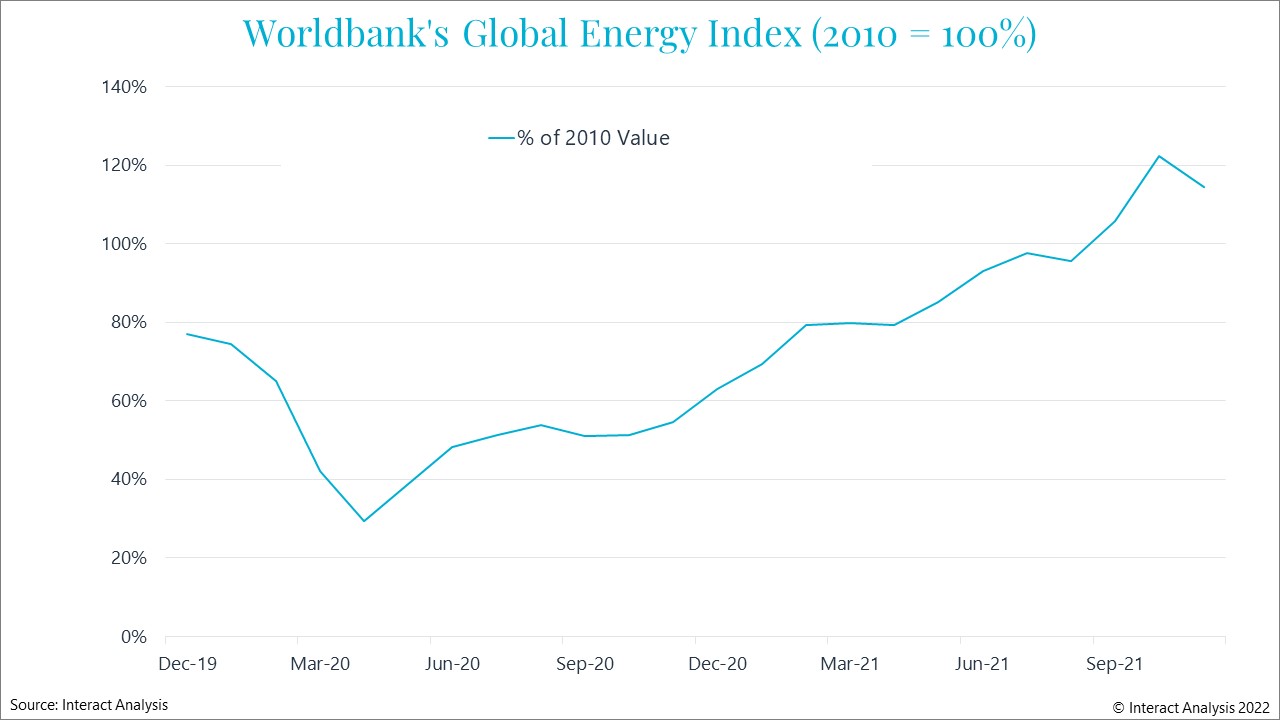

Our forecast is influenced heavily by the Worldbank’s forecast of commodity pricing. 2022 average price levels are impacted by raises seen in 2021 which occurred late in the year.

Final Thoughts

The motor market is undoubtedly stressed due to the increased pricing seen in 2021. Unit shipment growth fell slightly below the rate of growth for manufacturing production indicating that the increased price negatively affected the quantity of motors demanded. However, with the rate at which revenues are growing as a result of price increases, lower unit shipments and higher prices may be a favorable situation for motor vendors if margins remain strong. If so, higher prices could be on the horizon once again.

To continue this conversation, get in touch with Blake directly: Blake.Griffin@InteractAnalysis.com