工业自动化

2024-02-28

2024年中国制造业面临的三大挑战

Samantha Mou

Samantha负责支持Interact Analysis在工业自动化领域的研究。Samantha拥有经济学硕士学位,曾在德国进行工业设备和汽车零部件的市场研究工作。

The ongoing housing market crisis, weak domestic demand and nearshoring trend pose a triple threat to manufacturing growth in China during 2024.

At the start of 2024, the outlook for global manufacturing is looking sluggish and manufacturing in China is no exception. We have found a trio of challenges in the form of the ongoing housing market crisis, weak domestic demand and the continuing trend towards nearshoring and moving manufacturing to cheaper locations are hampering exports and domestic demand, squeezing Chinese manufacturing.

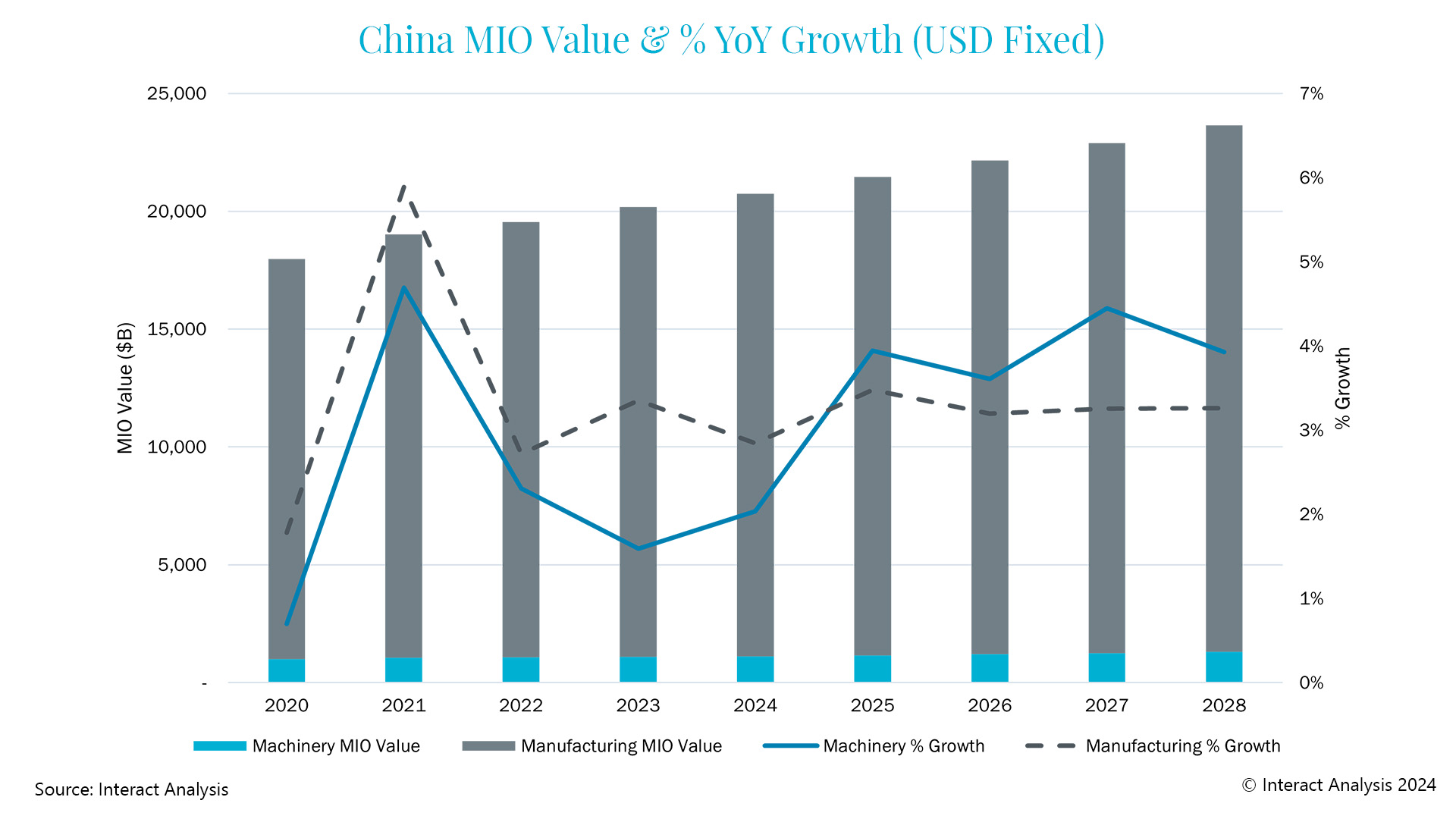

Interact Analysis’ Manufacturing Industry Output (MIO) Tracker is published every quarter and provides a crucial insight into the fast-moving manufacturing sector. The report covers over 102 industries and sub-industries, across 45 countries, and presents 15 years of historical data alongside a 5-year forecast.

The latest MIO Tracker indicates that monetary and fiscal policies in China will start to take effect, with more stimulus measures anticipated. However, growth still remains weak and the forecast for China’s MIO value growth in 2024 has been revised down from 3.0% to 2.6%. This follows on from two gloomy years for China’s manufacturing industry, with growth expected to pick up from 2025.

In order to better understand how China’s manufacturing industry is performing and its outlook for the future, we spoke with Interact Analysis Research Analyst, Samantha Mou.

Are economic issues such as the housing market crisis in China feeding through to manufacturing? Do you think they will continue to do so over the coming year?

Real estate is the ‘mother of cycles’, and the current downturn in China’s housing market has seriously affected economic and manufacturing growth. The real estate slump affects many manufacturing industries, such as aggregates, metal, and related machinery sectors such as off-highway commercial vehicles. The decline in house prices affects households’ assets and expected levels of consumption, impacting demand in overall consumer goods manufacturing.

However, the housing market in China is expected to be slow to recover, with the downturn likely to persist in 2024. We anticipate China’s real estate market will enter a low-growth cycle in the medium to long term, as China’s population growth is slow and people’s view of real estate as a good investment opportunity has changed. Fiscal and financial policies will be critical for China’s real estate market to achieve a soft landing.

In addition to the real estate crisis, the lack of market confidence and insufficient domestic demand is also affecting the growth of China’s manufacturing industry. Confidence and investment from private enterprises were damaged during the three years of the Covid-19 pandemic, while employment, consumer confidence and stock markets have all been sluggish over the past two years. In 2024, we expect China will focus on increasing government investments in ‘new infrastructure’ (the digital economy, IoT, etc.), supporting hi-tech manufacturing, and creating a right business environment for private sector growth. If there is strong political support, we expect confidence and domestic demand in China to recover ahead of the real estate cycle.

How will economic issues in China affect global manufacturing?

Throughout 2023, exports have performed worse than domestic demand, placing pressure on China’s manufacturing economy. Domestic consumption and investment in China increased by 7.2% and 3.0% respectively year-on-year, while the value of exports decreased by 4.6% in 2023, partly due to a significant decline in demand from Western markets. In 2024, as the global economy faces a downturn, we expect exports to continue to have a negative impact on manufacturing output growth in China. However, currency depreciation caused by expected interest rate cuts by the central bank of China may offset some of the decline in exports.

Nearshoring to Southeast Asia will also continue to impact the growth and structure of China’s manufacturing industry. Decreasing margins in 2023 have accelerated Chinese manufacturers’ decisions to move production to lower cost locations. For more than a decade, there has been substantial relocation of textile production and electronics assembly from China to Vietnam and Indonesia. In recent years we have also seen Chinese automotive manufacturers setting up factories in Thailand, including both traditional automakers and manufacturers of electric vehicles. Relocation is an inevitable result of China’s manufacturing shifting upstream in the value chain, and in the long term it helps Chinese manufacturers move towards advanced manufacturing.

Shortage of semiconductor chips and the weakness of China’s semiconductor industry is a bottleneck for China developing hi-tech manufacturing in the medium to long term. Due to US export restrictions, Chinese companies are having difficulties purchasing powerful semiconductor chips, which prevents many of them joining the rapid development of AI. There is still a long way to go before Chinese companies develop high-end chips independently.

Is the lower level of economic growth here to stay as the Chinese economy matures and countries such as the US introduce measures to reshore manufacturing? Or is it part of a cycle?

We expect the growth of China’s manufacturing output to stabilize and stay below the 2010s level, but 2022-2024 is still likely to be a bottom of a cycle. As indicated by the trend in China’s population growth, the Chinese economy will quickly shift to a mature state, and the previous high growth driven by labor intensive manufacturing is not sustainable. Reshoring initiatives introduced by the US may accelerate the shift, but trade conflicts with the US and nearshoring to the neighboring Asian countries are likely to have the biggest impact on China’s manufacturing industry in the short term.

We expect the period of 2022-2024 to be an exceptional downturn and the bottom of a cycle. Following two years of sluggish growth for China’s Manufacturing Industry Output (MIO) value, there are indications in 2024 that manufacturing investment in China may start to recover and Chinese government investments in infrastructure will increase. The inventory of manufactured products is thought to have been close to bottoming out in China at the end of 2023 and the capacity utilization rate is now picking up. We expect the industry to gradually enter a restocking cycle and from 2023 to 2028 we expect China’s MIO value to grow at a compound annual growth rate (CAGR) of 3.3%.

To learn more about our Manufacturing Industry Output (MIO) Tracker and China, get in touch with Samantha Mou directly: Samantha.Mou@interactanalysis.com.