机器人 & 仓储自动化

2023-04-07

2030年前全球将部署15万台采摘机器人,但前景仍需探索

IRENE ZHANG

Irene拥有应用经济学硕士学位,具备七年行业研究和跨国并购经验。在加入Interact Analysis之前,Irene曾在一家专注于投资全球半导体公司的私募股权公司工作。Irene将运用她的专业知识和经验,为仓储自动化领域的客户提供准确的市场分析和洞察,帮助他们做出明智的决策。

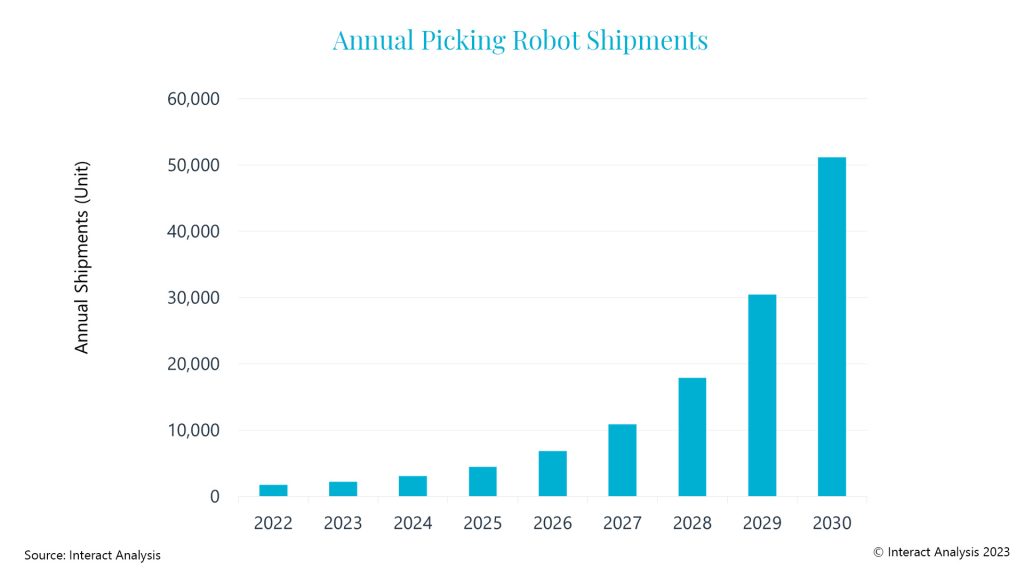

Substantial and accelerating growth is predicted for the robotic picking sector over the coming years, as labor costs rise and the cost of robots fall. At Interact Analysis, we forecast there will be just over 150,000 picking robots installed by 2030, with annual shipments jumping from less than 2,000 in 2022 to just above 50,000 by the end of the decade.

Demand for robotic picking expected to pick up pace towards the end of the forecast period

However, this is just the beginning and we’re going to see a large increase in adoption over the coming years, which will speed up as the benefits of robotic picking become more apparent. Uptake will be driven by rising wage costs in warehouses, labor shortages, and the rapid development of AI and machine vision technology.

The information in this insight provides a top-level summary of key industry trends and is taken from our upcoming Robotic Picking Report, which provides an in-depth look at the robotic picking market as a whole.

Falling robot costs, rising wage bills

Over time, the cost of warehouse labour is increasing, while the cost of robotic picking is gradually coming down. Picking tasks in the warehouses are extremely repetitive, and companies across the world have struggled to recruit and retain warehouse operators for several years, driving up the cost of labor. At the same time, we expect the price of robotic picking to come down significantly over the coming years, largely driven by pricing pressures for robotic arms and machine vision software. By 2030, we expect the average price of picking robots will drop by 40%, while the cost of warehouse labor will increase by approximately 30% over the same period.

Changing roles for warehouse employees

The types of roles carried out within a warehouse are changing over time. Historically, most employees have been very mobile due to the nature of person-to-goods picking. However, the rise of automation is leading to the growth of static manipulation roles within warehouses. We estimate there will be around 7.5 million global full-time equivalent (FTE) employees performing static manipulation tasks by 2030, which is more than double that of 2022. The growth of static manipulation roles is expected to be a large driver for the adoption of robotic picking.

AI technology improvements driving the market

Improvements to AI machine vision technology increase the range of items that can be manipulated by robots and boost the success rate of each pick. We currently assume that for every 3-5 robots, there will be a full-time equivalent (FTE) employee supervising them. However, we expect this will increase to one FTE per 7-10 robots by 2030, improving the unit-economics. What’s more, improved AI machine vision and path-planning increases the speed of robotic picking, further improving ROI. For example, we spoke with a representative of one of the leading robotic picking vendors at ProMat 2023, who mentioned the pick-rate of their robotic picking system has increased 17% year-on-year.

Barriers to Entry

There are, however, several barriers which the industry must first overcome. Firstly, the cost of robotic picking is still prohibitively high in many scenarios, particularly for one shift operations. It’s often mentioned that the industrial robots on the market today – which are designed for the automotive industry – are largely over-spec for logistics applications. They include expensive proprietary path-planning motion control software (which is often overwritten by the robotic picking vendors), along with extreme precision capabilities that are not required for warehouse picking operations. As a result, there’s significant demand for cheaper industrial robots that don’t include all the ‘bells and whistles’ found in robots currently on the market.

Furthermore, we hear that the programming of robots is still a challenge and requires the expertise of robotic engineers. There are currently 132k robotic engineers in the US and this will need to increase significantly to avoid labor becoming a major bottleneck to market growth. Increasing the labor pool of robotic engineers and reducing the complexity associated with programming industrial robots will be key to widespread adoption.

Looking to the future of robotic picking

Despite more than 150k picking robots expected to be installed by 2030, this represents just 2% of the number of FTEs forecast to be performing static manipulation tasks that year. As we’ve discussed, there is a convergence of factors which we believe will lead to widespread growth in the robotic picking segment over the next decade.

For more information on the market for robotic picking, contact Irene Zhang, Senior Analyst at Interact Analysis.