商用车

2023-04-06

2022年十大电动卡车品牌

Shirly Zhu

Shirly一直专注于制造业领域的市场研究,行业涉猎广泛,涵盖新能源、化工、工业自动化、海事、汽车等行业的全球及本地化调研项目,积累超10年的一手及二手信息调研、数据及行业分析经验。

Jamie Fox

15年+市场研究经验,涉及电动汽车及零部件等。他有物理学和天文学学士学位以及纳米科学和技术硕士学位,他在智利工作。

Medium and heavy-duty battery electric trucks are starting to take off in various places of the world, including North America and Europe. In 2022 however, one country dominated sales rankings: China.

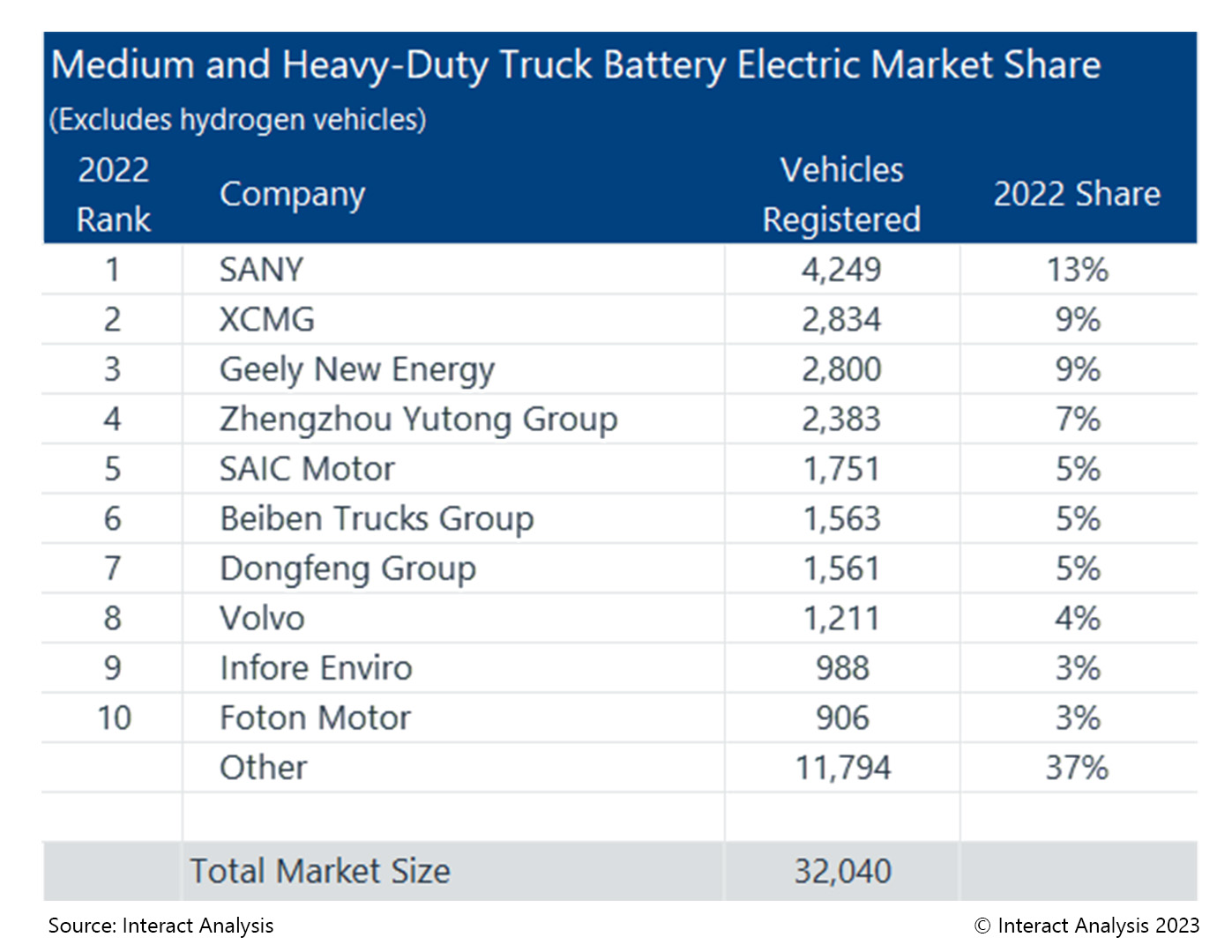

With the number of battery electric trucks registered in China as high as 24,075 and only 7,965 for the rest of the world combined (for a total of 32,040), it should come as no surprise that 9 of the top 10 truck manufacturers are from China. Sany is the leader with 13% market share. It has strong sales of battery electric semi-trailers and concrete mixer trucks. In 2022, total BEV medium and heavy-truck sales in China were more than double those of 2021. Promotion of battery-swapping models favored the sales of BEV heavy-duty trucks, which accounted for 51% of total BEV heavy and medium-duty trucks. Geely, XCMG, SAIC Motor and Sany were among major suppliers of battery-swapping battery electric heavy-duty trucks.

Medium and heavy-duty truck battery electric market share

We were slightly surprised that BYD falls outside of the list. Internationally, it has more truck sales than other Chinese companies, but its home sales fall below that of other competitors, according to official statistics and our research.

For now, Chinese companies are mainly selling domestically. We have not found comprehensive data for Chinese company export sales by manufacturer, but about 98% of their BEV medium and heavy-duty truck sales are within China and 2% internationally. While some companies such as BYD have stronger international sales, others have none at all.

Volvo is the only non-Chinese company to feature on the list – for now. Western (and Korean and perhaps Japanese) manufacturers will offer many more BEV models in the next few years and will likely catch up in the next few years, with more entrants coming to the top 10.

Hyundai is one such contender. Mitsubishi, Navistar and Tesla could also appear in the top 10 rankings in the future. Indeed, we have forecast that this market could increase 5x to over 150,000 in 2024, with the share of those BEV medium and heavy-duty truck vehicle being registered in China reducing from 74% in 2022 to 45% in 2024.

Another consideration though is that Chinese manufacturers are extremely likely over time to make more efforts to sell abroad. While geopolitical considerations and the Inflation Reduction Act and others may make the US a little tricky as a target market, there are many markets that are much open to Chinese electric vehicles, especially at competitive prices. This includes Europe and Latin America. So while 2024 will see a more mixed picture, China will likely continue to be the strongest country in the market share rankings.