商用车

2022-09-07

博世收购Hydraforce将如何影响未来市场?

Brianna Jackson

Brianna拥有生物学和化学学科背景,她对可持续发展和医疗技术有着浓厚的兴趣,为IA团队在这些领域的专业知识增添了更深层次的洞察和见解。

As of July 2022, Hydraforce agreed to be acquired by Bosch Rexroth for an undisclosed sum. On the surface, the advantages this acquisition offers Bosch Rexroth are obvious. The seemingly preeminent advantage of a merger of this magnitude would be increased global market share, but we see another asset that Hydraforce provides the hydraulic juggernaut.

Two Birds with One Stone

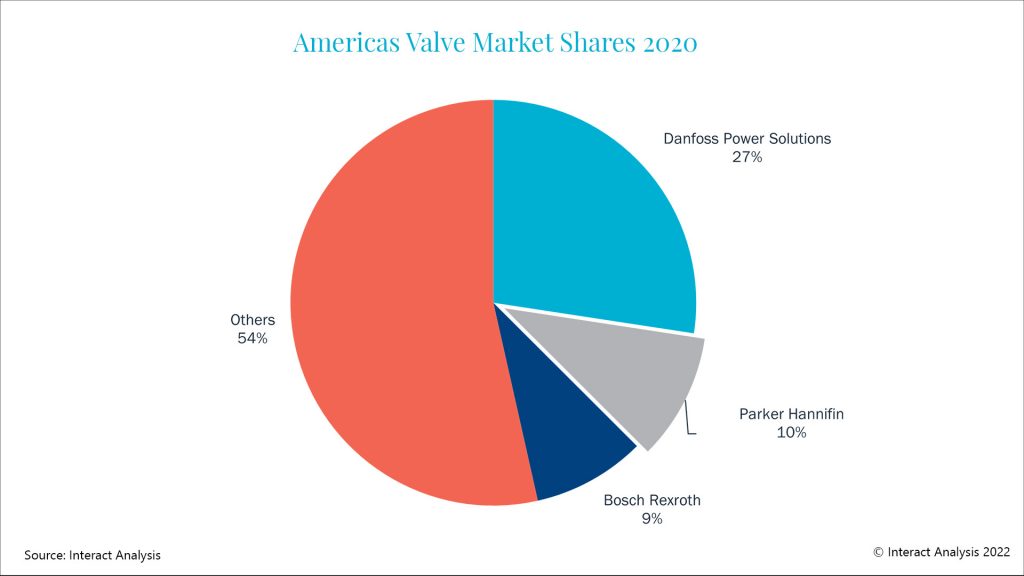

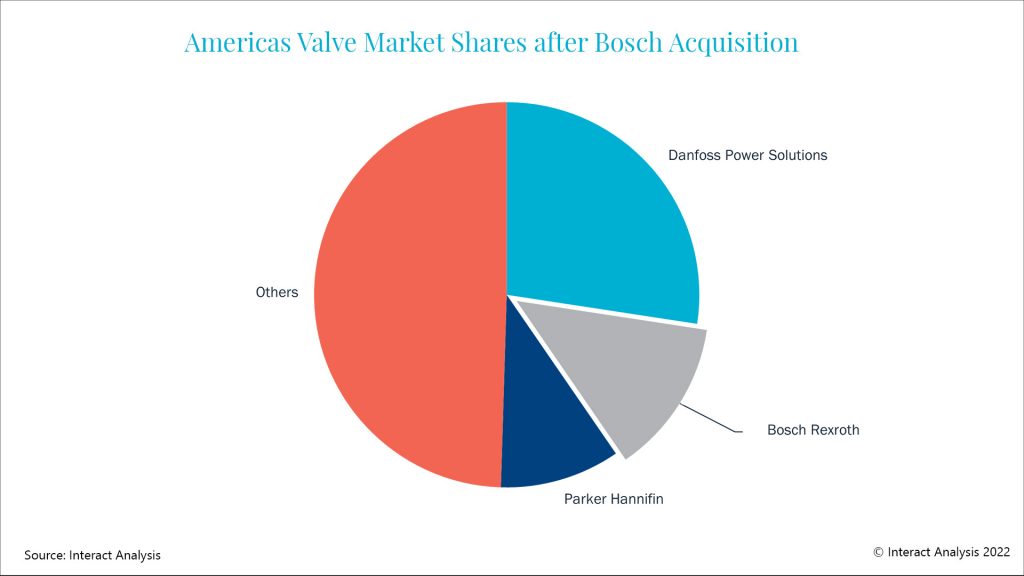

While Bosch Rexroth has been a Goliath of the global hydraulics market for decades, this giant had a weakness in its portfolio: the American mobile hydraulics market. Historically, the Americas has been the weakest region of revenue generation for Bosch Rexroth. With the addition of Hydraforce, we expect Bosch’s total share of the American mobile hydraulics market to increase by a full percentage point, narrowing the gap between Bosch’s third place and Parker Hannifin’s second place. For the American valve market, the merger has an even more tangible effect with Bosch set to overtake Parker Hannifin and ascend to the number two spot.

Americas valve market shares 2020

Americas valve market shares after Bosch acquisition

Beyond increasing market share, this acquisition also expands Bosch’s ability to navigate indirect sales channels by offering Bosch a greater network of distributors. This is significant because the US hydraulics market is more heavily dependent on distribution than any other region. Having access to these indirect channels will allow Bosch to benefit from the relationships and customer base Hydraforce has cultivated. Additionally, these distribution networks can serve as buffer to minimize lead times amid perennial supply chain woes.

What else is in it for Bosch?

While increased market share is a definitive advantage of this acquisition, we believe it is secondary to Bosch’s long-term goal of being a leader within hydraulic IoT. For years, Bosch has been developing its IoT offering for off-highway machinery. Termed BODAS, the digitalization solution is designed to provide insight into both operations, as well as the health of connected devices.

Before the acquisition, Hydraforce had built out a full IoT offering for fleet-management. Hydraforce’s GlobE IoT solution includes hardware devices such as a communication gateway device for aggregating and communicating data, and electronic control units for use in electrohydraulic applications. This, combined with a full suite of remote monitoring and cloud service software, represents a full mobile hydraulic IoT offering; something rare within the hydraulic vendor landscape. We expect this product suite was likely of particular interest to Bosch upon deciding this acquisition and it will now fall within the BODAS offering.

As hydraulic components become more integrated with electronics, IoT can provide hordes of data about how the individual components are performing. This is becoming increasingly important as OEMs strive to add more autonomy to systems within off-highway vehicles in an effort to help bridge a widening skill gap within the labor force of the construction and agricultural sectors. Long term, the addition of Hydraforce’s GlobE IoT Solution will aid Bosch in addressing this issue.

Final Thoughts

As the off-highway market progresses more intensely towards electrification, data on vehicle duty-cycles has risen in importance. This data is being used to more effectively optimize componentry within the hydraulic system to enable higher efficiencies across the vehicle. For example, Bosch Rexroth now offers up to 80 variations of its off-highway motor. The selection of which to use depends on the duty-cycle of the vehicle. All of this is in an effort to optimize the system for higher efficiencies.

We expect that hydraulic vendors who are most knowledgeable on duty-cycle requirements will have a competitive edge in the market going forward. Developing a robust IoT offering can aid in gathering such data and we expect more acquisitions to emerge on this basis.